There are better renditions of Jerusalem on the web, but the Flying Circus crowd are amazingly good.

. . . And:

The idea here is that capital cuts in service of the Labour Government's pursuit of the New Jerusalem in the 1940s led to bad motorcycles in the 1970s. That is, to the collapse of the British motorcycle industry, and, more specifically, the bankruptcy of BSA in November of 1972.

Well, okay, that's the vulgar read, which I would attribute to Correlli Barnett if I could be bothered to read Lost Victory and find out whether he is even aware of the 1947 capital cuts. For now, I'm going to satisfy myself with David Edgerton's review in the London Review of Books, which is pretty boss, and the fact that Barnett showed up in the comments to whine is priceless. That David allows the concession that the Brits could have reduced their calorie intake to German levels to squeeze out some more capital also allows me to go on for a bit about food and health at the bottom of this post.

I probably shouldn't be promising more on food and health than I can deliver. My hunch is that there is a huge issue here, but what I've got right now is a silly and tendentious man on RT. As for whether the 1947 capital cuts had any real effect, much less knocking on to the failure of BSA and Norton Villiers Triumph in the mid-70s, it all turns out a bit anticlimactic. Non-vulgar economic historians don't think that the cuts even happened.Since this is an appendix to a postblogging entry, and not a definitive statement about the effects of these capital cuts, I am going to feel out the extent to which it is possible to push back against that consensus.

On Capital Cuts

I should start with the doyen of the field, the late Alex Cairncross. In his Years of Recovery: British

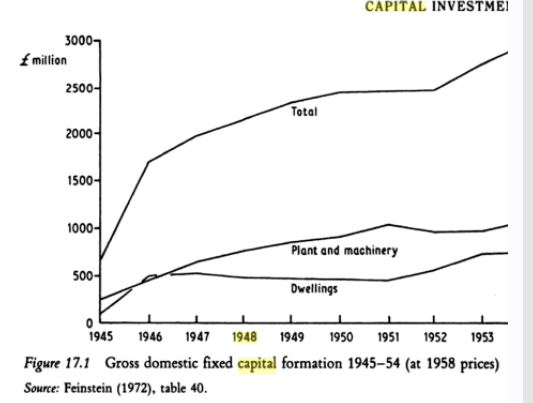

Economic Policy 1945—51* . It’s awesome. Cairncross apparently reads the The Economist, because he agrees that steel and timber restricted investment as much, if not more than, money, and cites a white paper, The Economic Survey for 1949 as admitting that the capital cuts never actually happened. The Working Party credited this to an increase in steel output and Marshall aid, but Cairncross thinks that it was just as likely that the control over investment was not very effective. He has a nice chart showing the non-existence of the capital cuts that I felt guilty about scraping until I learned that he just graphed some data from a chapter in The Cambridge Economic History of Europe. Not only am I not guilty about the scraping any more, I can also show my face to the world after using a chapter from the CNHEME in my thesis!

**

However, taking Barry Eichengreen on board*** leads Cairncross to the more restrained observation that these were cuts in programme, not the current level of expenditure, and “are correspondingly difficult to trace afterwards.” In other words, the chart above is rubbish, because we need to see the counterfactual. I would have spared you this diversion down a blind alley were our grand old men not ready to make some useful points. Above all, there was nothing wrong with the British economy. Although the money supply at home was large, and the banks under-lent and awash with liquid funds, while business was also highly liquid, the consumer price index rose at an average rate of only 5%/year in the first five postwar years, about half the American, I think. (Our Eminences choose to phrase it as “half as fast as the American GNP deflator in the first three postwar years.”) This is not the place to get into their argument over the devaluation, still months off and with the Berlin Airlift to go, in the postblogging series. I do want to mention that having a co-writer doesn't change Cairncross' opinion that it is all down, in the end, to the Korean War rearmament.

Peter Burnham isn't famous, and perhaps took the assignment a bit more seriously in his The Political Economy of Postwar Reconstruction****. First, he summarises the story for those not interested in teasing out the details from my elliptical summaries of old Economist articles. The capital cuts were intended to redirect resources, particularly steel, away from long term reinvestment to exports to make up Britain's ongoing trade deficit with the dollar area, which was threatening the economy in vague and general terms, and the food supply, in very alarming and specific ones. The Investment Programmes Committee proposed an 11% capital investment cut in 1948, the FBI proposed 25%, and the Cabinet went with 25%.

|

| The face of a contrarian |

Burnham must read his Economist, too, because he is at pains to remind us that only 11.5% of British imports were covered by the Plan in July 1948—June 1949, and 7.5% in 1950, and 42% of that was for food, with machinery and vehicle imports only 0.4%. (112) “Minor” capital investment cut and, more importantly, tighter rationing was alternative to Marshall aid. At this point, my self-aggrandising joke about how all these economic historians must be reading old issues of The Economist fails me. I don't think that Burnham understands just how severe rationing was!

Finally --and I am not going to pretend that this was a serious research exercise, or anything like that, we have an author who actually uses some archival and contemporary material, as opposed to a copy of a Cambridge History. (But they're so big and blue!) He even reads some back numbers of the Times of London! There, Martin Chick***** digs up an exchange in the Times in which an appalled writer argues

that while there had been a net industrial

investment of £250 (1947 prices) in 1938, there had been a net

disinvestment of £200 million in 1946 and only £200 million and £300 million in

1947 and 1948, respectively. Not only was this too low, but it focussed on

fuel, power, transport, steel and chemicals, with engineering left as the

Cinderella among industries. Our other authors have noticed the difficult numbers for 1946, and I, personally, quail at anyone claiming that anything is the "Cinderella" of X. Did you know that Bomber Command was the Cinderella of the wartime RAF? It must be true, because Arthur Harris says so.

Not to spend any more time making fun of mad bombers, Sir Norman Kippering, Director-General of the FBI, took up these points soon afterwards, and this is where even some half assed research helps, as Chick digs up The Investment Working Party’s Economic Survey for 1946 found that of gross domestic fixed capital investment in 1946, £1055 would be net investment, £540 million depreciation and maintenance. With a national income of £8120, this produced a ratio of 19.6% gross and 13% net. Gross investment is 5% higher than in 1938; net investment 40% lower. Using the Central Statistics Office, National Income and Expenditure 1946—1952, London: HMSO, August 1953, Table 43), Chick shows that gross domestic fixed capital formation in new buildings and works ran from 44.5% in 1948 to 39.8% in 1951, and was dominated throughout by housing at the expense of factories, which held comparatively constant between a low of 14.2% and 15.2% of building investment. Critics at the time noted that UK net investment in the range of 5% of net national product in 1950—1 compared unfavourably to 14% in Germany, 7—8% in France and 21—22% in Finland. Gross, at 22% (bearing in mind differing depreciation cost calculations) was still “not extraordinary” compared with, say, 25% in the US in 1925—9, 25% in France under the Monnet Plan, and 22.5% in the Soviet Union’s Four Year Plan. David Edgerton points out that Britain was so much richer than these other countries that these comparisons aren't really useful, because can you really spend that much more money?

Chick, and critics at the time, would say that it is other limiting factors (again, steel, timber, labour) that need to be considered. After all, it was to conserve these that the capital cuts were needed in the first place! The Economist being all a-pant over housing investment, this is probably the place to begin, as it is not likely to be wrong so much as inhumane. Chick agrees, pointing out that housing investment might be no higher than in the prewar period, but “opportunity costs” were. New house building might required only 250 tons of steel for every £1 million done, compared with iron and steel, 10,000; 6000, railways; 3—4000, engineering, but the sheer size of the housing programme made it the third largest user, at 98,000 tons. that being said, that is not a large share of fourteen million tons. So it is labour and other construction materials that are the main issue. It is interesting that British construction materials were mainly sourced from Russia and “Russia-controlled countries” at the time. As for labour, Chick notes that the adult training schemes in semi-skilled construction trades were ended in 1947 “as part of the investment cuts—” and partly in response to industry’s worries about an over-supply of labour. (Again, we've heard this from The Economist. It is still nice to see one thing that the capital cuts directly affected.) Labour recruitment to the construction trades was therefore left to the traditional apprenticeship programme, which was enrolling 14,000. The problem was that it was estimated that apprenticeships needed to take up 22,000 to maintain the industry, which looks like the overall problem of not enough young people.

Chick also pursues the question of whether or not all of that housing investment was mere coddling. Only “6—9”% of prewar British housing stock had been lost in the war, compared with 20% in Germany, Poland and Greece, and with the large existing stock, the new house-building only added 1.5%. It's strange that the loss in housing stock should be the same in Poland and Greece as in heavily-bombed Germany. I am also wondering about the relationship between destruction, damage and slum clearance and New Towns.

There is also a demographic factor to consider. A two million increase in population since 1939 was accompanied by an increasing rate of household formation, leading to 530,000 separate families. Also, Labour wanted to do something about overcrowding. Again, there is room to be inhumane about this. The Housing Act of 193 defined overcrowding as more than two people per habitable room, in which case it was not a serious problem outside of places like the Glasgow tenements and back-to-back houses in Northern England,. If overcrowding meant more than 1 per inhabitable room, than 23% of Britons were overcrowded in the postwar era. Also to be taken into account was the increasing age of the existing stock, and demand for schools and hospitals to consider, the former more important than the latter, notwithstanding the new NHS. This might be the one place where Barnett's made a brief and glancing encounter with reality, had he emphasised that the Labour government chose not to invest as much as it ought to have in new hospitals, rather than blithering on about how the country (secretly) couldn't afford it. (Again, balance of trade deficits are not budget deficits, and to even explain the idiocy of worrying simultaneously about budget deficits and low interest rates is to endorse the power of financial jargon to obfuscate reality.) In the end, I am more struck by the shift in demand from tuberculosis to maternity beds. The ongoing trend to reduce lying-in times for new mothers is driven both by the shortage of beds and a recognition that they don't need it. But where does that increasing neo-natal robustness come from?

After I wrote that, I thought to myself, "Myself, it's pretty idiotic not to Google around to see what actual experts say." So here's the CDC, admittedly talking about the American case:

Shorter lying-ins seems to be a pragmatic response to the steep decline in postneonatal deaths; and the causes of postneonatal deaths seem to be found in the baby's environment. If this were an Eighteenth Century novel, the subtitle would be Or, Labour's Concern for Overcrowding, Vindicated.

Hauling myself back from the capital cuts/housing/urban renewal/NHS+public education nexus, I want to look at K. Zweig's "plain disaster" in the making. Here are his cut on the numbers, which have the main advantage of not being Feinstein's. It's not that I disagree with Feinstein, but we do have something to explain (the collapse of British industry thirty years out), and an hypothesis. It might be a good idea to take in a perspective outside of the modern consensus. So here is Zweig being a Cassandra, retyped for search and cut-and-paste purposes.

Also, it looks like I have a typo, and that our correspondent is actually Ferdynand Zweig (1896--1988) [wiki] It certainly appears that the "repair and renewal" figure is so far under the 1938 figure going forward that British industry is facing a galloping depreciation crisis.

Okay, so much for that. Since the plural of "anecdotes I find personally relevant" is "data," I am going to take the shallowest imaginable dive into the death of the British motorcycle, deploying some kind of rationalisation about "case study," because that's what you do on a blog on a Friday morning, as opposed to skimming Wiki links.

This is the BSA Works, on Armoury Road, Small Heath, Birmingham, in 1968. Source. Small Heath was a site just outside of the city where drovers used to pasture their animals while waiting for the meat market to open. Birmingham Small Arms was an association of gun smiths in the Gun Quarter of Birmingham who banded together in 1861 to get back into the game after the Royal Arsenal, Enfield, bought some American machine tools and launched into the "American" (actually French, but who cares, right?) system of firearm manufacture. The company bought some machine tools, a 25 acre parcel in Small Heath, and secured a Turkish rifle contact in 1863 that must have made some money, since the factory was shut down for a full year in 1879 when its 1868 War Office contract ended. Instead of lapsing into bankruptcy, BSA branched out into bicycles, which, the wiki author tells us, were "remarkably adaptable" to the new style of small arms manufacture, selling the bicycle side of the business to Raleigh in 1953. It added bicycle hubs in 1893, and this much more demanding industrial sideline survived at Small Heath for another two years, until 1955. Motorcycles were added to bicycles in 1910, and the original and new BSA business merged with War Office orders for the M20 in 1939.

The M20 being perhaps not the thing for postwar markets, the B31 was introduced in 1945

. . And the Gold Star revived. A racing model hand-built on the bench for every order, the Gold Star might have defined everything the average old-time motorcyclist thought he knew about Britain's high-skilled, mass-production-averse industry.

Except that its job was to win the Isle of Man and win mass production ("unit orders") for more market-friendly models like the Golden Flash.

Pardon me for going into the weeds a bit, here. Frankly, I had no inkling of most of this stuff when I began following Wiki links an hour ago. Wiki says that eighty percent of Golden Flash production was designated for the United States,and that British customers were offered the model only in black, which is an old engineer's joke my father told me with respect to the Model T, for which it was never true. ("They can have any colour they want, as long as it's black." It was supposed to be an illustration of how mass production works, and fair enough. Except that it's about BSA, not Ford.)

. . And, finally, this crotch rocket, the hopefully-named BSA Spitfire, produced from 1965 to 1968. (I find it more than a bit ironic that the 1967 Mark III was marred by an unsuccessful enlargement of the fuel tank.)

*London: Routledge, 1985; Reprinted Milton Park, etc.: Routledge, 2006.

**Feinstein, C. H. (1978) “Capital formation in Great Britain,” pp. 28-96 in P. Mathias and M. M. Postan (eds.) The Cambridge Economic History of Europe, Vol. 7 (pt. I). London: Cambridge Univ. Press.

***Cairncross and Eichengreen, Sterling in Decline: The Devaluations of 1931, 1949 and 1967, 2nd Ed. (Houndmills, etc.: Palgrave Macmillan, 2003)

****(London: Macmillan, 1990; reprinted New York: St. Martins, 1989.

*****Martin Chick, Industrial Policy in Britain, 1945—51: Economic Planning, Nationalisation and the Labour Governments (Cambridge: CUP, 1998) (21—3)

Not to spend any more time making fun of mad bombers, Sir Norman Kippering, Director-General of the FBI, took up these points soon afterwards, and this is where even some half assed research helps, as Chick digs up The Investment Working Party’s Economic Survey for 1946 found that of gross domestic fixed capital investment in 1946, £1055 would be net investment, £540 million depreciation and maintenance. With a national income of £8120, this produced a ratio of 19.6% gross and 13% net. Gross investment is 5% higher than in 1938; net investment 40% lower. Using the Central Statistics Office, National Income and Expenditure 1946—1952, London: HMSO, August 1953, Table 43), Chick shows that gross domestic fixed capital formation in new buildings and works ran from 44.5% in 1948 to 39.8% in 1951, and was dominated throughout by housing at the expense of factories, which held comparatively constant between a low of 14.2% and 15.2% of building investment. Critics at the time noted that UK net investment in the range of 5% of net national product in 1950—1 compared unfavourably to 14% in Germany, 7—8% in France and 21—22% in Finland. Gross, at 22% (bearing in mind differing depreciation cost calculations) was still “not extraordinary” compared with, say, 25% in the US in 1925—9, 25% in France under the Monnet Plan, and 22.5% in the Soviet Union’s Four Year Plan. David Edgerton points out that Britain was so much richer than these other countries that these comparisons aren't really useful, because can you really spend that much more money?

Chick, and critics at the time, would say that it is other limiting factors (again, steel, timber, labour) that need to be considered. After all, it was to conserve these that the capital cuts were needed in the first place! The Economist being all a-pant over housing investment, this is probably the place to begin, as it is not likely to be wrong so much as inhumane. Chick agrees, pointing out that housing investment might be no higher than in the prewar period, but “opportunity costs” were. New house building might required only 250 tons of steel for every £1 million done, compared with iron and steel, 10,000; 6000, railways; 3—4000, engineering, but the sheer size of the housing programme made it the third largest user, at 98,000 tons. that being said, that is not a large share of fourteen million tons. So it is labour and other construction materials that are the main issue. It is interesting that British construction materials were mainly sourced from Russia and “Russia-controlled countries” at the time. As for labour, Chick notes that the adult training schemes in semi-skilled construction trades were ended in 1947 “as part of the investment cuts—” and partly in response to industry’s worries about an over-supply of labour. (Again, we've heard this from The Economist. It is still nice to see one thing that the capital cuts directly affected.) Labour recruitment to the construction trades was therefore left to the traditional apprenticeship programme, which was enrolling 14,000. The problem was that it was estimated that apprenticeships needed to take up 22,000 to maintain the industry, which looks like the overall problem of not enough young people.

Chick also pursues the question of whether or not all of that housing investment was mere coddling. Only “6—9”% of prewar British housing stock had been lost in the war, compared with 20% in Germany, Poland and Greece, and with the large existing stock, the new house-building only added 1.5%. It's strange that the loss in housing stock should be the same in Poland and Greece as in heavily-bombed Germany. I am also wondering about the relationship between destruction, damage and slum clearance and New Towns.

There is also a demographic factor to consider. A two million increase in population since 1939 was accompanied by an increasing rate of household formation, leading to 530,000 separate families. Also, Labour wanted to do something about overcrowding. Again, there is room to be inhumane about this. The Housing Act of 193 defined overcrowding as more than two people per habitable room, in which case it was not a serious problem outside of places like the Glasgow tenements and back-to-back houses in Northern England,. If overcrowding meant more than 1 per inhabitable room, than 23% of Britons were overcrowded in the postwar era. Also to be taken into account was the increasing age of the existing stock, and demand for schools and hospitals to consider, the former more important than the latter, notwithstanding the new NHS. This might be the one place where Barnett's made a brief and glancing encounter with reality, had he emphasised that the Labour government chose not to invest as much as it ought to have in new hospitals, rather than blithering on about how the country (secretly) couldn't afford it. (Again, balance of trade deficits are not budget deficits, and to even explain the idiocy of worrying simultaneously about budget deficits and low interest rates is to endorse the power of financial jargon to obfuscate reality.) In the end, I am more struck by the shift in demand from tuberculosis to maternity beds. The ongoing trend to reduce lying-in times for new mothers is driven both by the shortage of beds and a recognition that they don't need it. But where does that increasing neo-natal robustness come from?

After I wrote that, I thought to myself, "Myself, it's pretty idiotic not to Google around to see what actual experts say." So here's the CDC, admittedly talking about the American case:

The discovery and widespread use of antimicrobial agents (e.g., sulfonamide in 1937 and penicillin in the 1940s) and the development of fluid and electrolyte replacement therapy and safe blood transfusions accelerated the declines in infant mortality; from 1930 through 1949, mortality rates declined 52% (4). The percentage decline in postneonatal (age 28-364 days) mortality (66%) was greater than the decline in neonatal (age 0-27 days) mortality (40%). From 1950 through 1964, infant mortality declined more slowly (1). An increasing proportion of infant deaths were attributed to perinatal causes and occurred among high-risk neonates, especially low birth weight (LBW) and preterm babies. Although no reliable data exist, the rapid decline in infant mortality during earlier decades probably was not influenced by decreases in LBW rates because the decrease in mortality was primarily in postneonatal deaths that are less influenced by birthweight. Inadequate programs during the 1950s-1960s to reduce deaths among high-risk neonates led to renewed efforts to improve access to prenatal care, especially for the poor, and to a concentrated effort to establish neonatal intensive-care units and to promote research in maternal and infant health, including research into technologies to improve the survival of LBW and preterm babies.

Shorter lying-ins seems to be a pragmatic response to the steep decline in postneonatal deaths; and the causes of postneonatal deaths seem to be found in the baby's environment. If this were an Eighteenth Century novel, the subtitle would be Or, Labour's Concern for Overcrowding, Vindicated.

Hauling myself back from the capital cuts/housing/urban renewal/NHS+public education nexus, I want to look at K. Zweig's "plain disaster" in the making. Here are his cut on the numbers, which have the main advantage of not being Feinstein's. It's not that I disagree with Feinstein, but we do have something to explain (the collapse of British industry thirty years out), and an hypothesis. It might be a good idea to take in a perspective outside of the modern consensus. So here is Zweig being a Cassandra, retyped for search and cut-and-paste purposes.

|

|

1938

|

1940/44

|

1945/47

|

1947

|

1948

|

|

Gross investments

|

1900

|

|

|

1,550

|

1,320

|

|

Repairs and Renewals

|

1160

|

|

|

775

|

775

|

|

Net Investment

|

740

|

2000—2300

|

1300—1400

|

775

|

545

|

|

Physical Destruction

|

|

2200

|

|

|

|

|

| Copyright asserted for Ron Cobb, 2018. I think I have to do that if he forgets to date the title, right? |

1968 has already come up as the year of the picture of the BSA Small Heath factory, above, was taken. The company was in trouble, although perhaps devaluation saved it in the short term, as it made it to November of 1972, when the company, with the Fury

in development and £20 million in debt, was forced into a merger with Norton. The end of the article on the Fury notes that BSA's debt was in large part incurred by the modernisation of Small Heath and its research and development facility at Umberslade Hall, equidistant from Small Heath, the Triumph factory at Meriden, in use since the original Triumph plant was destroyed in the Blitz, and a factory in the New Town of Redditch. I'm not sure why this information is scattered around various specialist articles instead of being included in the main one about BSA, but I imagine that amateurs prefer not to linger over the death and dissolution of the company, especially considering the success of British motorcycle marques since the mid-80s or so. So what was wrong with BSA?

At the time that I exited motorcycling as a hobby/highly impractical mode of transport in 1991, the consensus was that the "British disease," as explained by your Wieners and your Barnetts, had killed the domestic motorcycle manufacturing industry. The maintenance-intensive nature of the British bike had driven the consumer to Japanese makes, and the British simply could not recover due to being unable to achieve full technical efficiency on account of having been taught Latin in high school, which makes your brain soft. The wiki author, for one, thinks that it is linked to the introduction of electric start on Japanese motorcycles. I'm not completely sold, since I experienced the delights of the kickstart on a 1976 Suzuki GT500, and of an electric push-start on a 1982 Suzuki GS6650E, too late for this neat little story.

On the other hand, there's a funny story about that, where by "funny" I mean the haunting memory of one too many humiliations. By the time I parted with my Suzuki GS650E in 1991, problems with its electric starting had migrated from the neat little push button to the dynamo armature. It started with the push button's retaining gasket seal falling out, a not uncommon phenomena that, the mechanic told me, could be addressed by either replacing the entire housing at an exorbitant cost of $60, or by taking up shorting the plates in the housing with a wire brush. This, naturally, led in time to the plates fusing, and so much for shorting, a phenomena that announced itself up a logging road high above Mabel Lake. I'll draw a veil over my pathetic response, but the upshot is that this time my mechanic taught me to short the poles of the starter motor, an exciting activity involving a great deal of sparks, but fairly safe at the amperage, especially when you used a screwdriver with an insulated handle, as most screwdriver handles are, for reasons that the manufacturers do not spell out for fear of sounding condescending. I finally splurged on a new starter unit just before my trip across Canada to attend the doctoral programme at the University of Toronto, and my first (and, in retrospect, ominous) learning experience was to have the said armature fail. Another mechanic told me that that was the sort of thing that happened when a cheap (that is, cheaper than a BMW) bike hit 60,000km mileage, and since I'd also had the bearings on the speedometer needle fail during the trip --something that, incredibly, could not be fixed without unsealing the odometer, which is illegal-- I sold the bike at a garage sale for more than I thought it was worth, and brought an end to my youthful experience of this highly impractical mode of transportation.

What I'm saying is, I've been converted by experience to a tiny bit of skepticism about the claim that Japanese electrics were better than British, unless British were really, really bad. And if they were that bad, well, no wonder the British bike died.

And, yet, if I had stayed in the hobby and paid attention to the trade press, that very year I would have heard about the latest, exciting machine from Britain.

.

|

| The 1991 Triumph. By meriden.triumph - Flickr: 1991 Hinckley Triumph Trophy 1200cc, CC BY 2.0, https://commons.wikimedia.org/w/index.php?curid=18390475 |

This is a sexy picture of a Triumph motorcycle. In 1972, Triumph was a BSA marque, and went down with it, not without some labour movement guerilla warfare. The brandname was picked up by a British entrepeneur who relaunched the brand with this 1200cc motorcyle in 1991, built in a brand new factory with CDC machinery. As of 2017, the new Triumph employs 700 and exports 85% of its production, although the 9400 motorcycles sold in the UK in 2017 was a company record.

As the record of this blog will show, I am not entirely convinced that learning Latin makes your brain soft. If pressed, I'm even willing to offer a defence of the claim that Confucian learning doesn't make your brain soft. If there is an explanation for the collapse of the British motorcycle industry in 1972, it is going to be something a bit less abstract, and the explanation already given serves perfectly well: BSA put itself too far into debt upgrading its plant.

This is an oblique aerial shot of the BSA works at Small Heath, taken in 1920. According to Robert Ferris, who posted this on WarwickshireRailways.com, the main BSA site is the long rectangle sandwiched between the Great Western Railway and the Gand Union Canal. "Sandwiched" raises a shudder for anyone who has worked in a congested, old facility. (If you've never had that experience, call me and I should be able to get you a tour of our 25th and Oak store.) The moddish looking building on the left is a Truscon building, erected in 1915, while the original, Victorian works seen in the street photo above, is on the right. (The building beyond the rails is another BSA facility, the Waverley Works.

I'll say this for a factory wedged between a railway and a canal; While it may be congested, it will be very easy to find from the air! On 19 November 1940, 440 bombers of the German Air Force demonstrated this by unloading some 400 tons of conventional bombs and 18 of the original "blockbusters," parachute-retarded sea mines repurposed for anti-structural work after the Germans observed the devastating effect of mis-aimed mines earlier in the Blitz. Birmingham suffered 450 deaths and 540 severe injuries, and both Lucas and GEC were hit hard, but the BSA works took 8 bombs, including one dud in the canal, of which two fell on the entrance of the Truscon Works, one in the road, two in the "Small Arms Factory," and one HE "at the back of the old Victorian factory, according to a very helpful and knowledgeable "brummie," (Birminghamite, I'm guessing). Rewdco went on to post a personal account noting that the night shift workers were on their machine tools until bombs actually began landing in the city, and then chose to shelter in the basement of the "new works." WWI-era reinforced concrete proved not up to the test, and the works collapsed on them,with a single worker pulled alive from the rubble, and 53 (or 81, as there seems to be a fair amount of improvisation with the details) killed along with 89 injured, presumably from other areas of the works. The loss of this building affected 1600 machine tools and halted rifle production for three months, and in a happy convergence of the interests of enthusiasts and independent scholars, rewdco also used the register of M20 serial numbers to establish that the raid interrupted motorcycle production for a month.

|

| Wikipedia says that this is "a damaged factory in Birmingham, November 1940." Could be BSA, but it could also be Lucas or GEC. |

If ever there were a case made that the capital cuts of 1947 had knock-on effects, it's in the thought that BSA went belly-up in 1972 trying to rebuild what the Germans knocked down in 1940. Or, at least, rebuilding a rushed and unsatisfactory repair. Remember, the British economy is not planned to the last detail. The Government can only achieve its capital cuts by a combination of exhortation and license restrictions. The perception at BSA, at least, is that licenses for steel were only forthcoming for export production, and, as The Economist sourly notes, the licenses for construction material and labour were in excess of the actual supply. Just getting a license to do repair work at Birmingham did not guarantee enough timber and steel to do a proper job. That doesn't mean that a bad job was done -only that the statistics upon which the story of the ineffective capital cuts are based isn't going to capture someone deciding that a wall could be left to lean a bit, and workers relied on to figure out how to hold their mouths right and get doors to open and close. (I speak from experience, and with some frustration at the difficulties of keeping our bananas warm at the Point Grey store, which does have twisted runners on the loading bay door that aren't going to be fixed short of knocking a wall down and rebuilding it.)

I can conjure up a plausible story about twenty-five years of slow leaks down a wall that doesn't quite match the ceilings, and no more. There's certainly not going to be anything on that subject here, although I'm embedding it all the same.

\

So take all this stuff about motorcycles for what it's worth. Could be about the capital cuts, might not be.

Population

Now for my crazy Russian person! The developed world's turn to positive population growth in the wake of World War II is kind of a bit deal, so I've been trying to keep an eye on it, otherwise I wouldn't be giving the time of the day to a Russia Today presenter, with an argument that boils down to the usual "I'm not a poopyhead, you're a poopyhead!" Specifically, why are Americans on about the alleged Holodomor. asks "historian Boris Borisov," when Americans won't acknolwedge the American Holodomor, when seven million Americans were "lost" to "the invisible hand of the market" in 1929--32. The argument isn't presented any too clearly, but Borisov thinks that the American population in 1940 should have been 141,856,000; and was, instead, 131,409,000.

The approach will be familiar from the Robert Conquest school, which tries to reconstruct the grim toll of Soviet collectivisation by close readings of census returns --the difference being that the Soviet returns were falsified. Although, of course, Borisov implies that the American Census was, too. Giving Borisov the benefit of the doubt, the final return of the 120, 1930 and 1940 Censuses are, respectively: 106,021,537; 123,202,624; 132,164,569. Extrapolating the 16% increase from 1920 to 1930 through 1940 gives 143,167,954.Borisov seems to have done something akin to this (taking net emigration into account), to come up with his seven million deaths. There's some talk of foreign sourced more trustworthy than the American census, but this turns out to be nothing more than a claim that, in general, famines cause half of their population loss from depressed birth rates, and half from increased mortality rates. It can't just be that the population didn't grow as fast (fewer babies, and, of course, the end of immigration). It has to be half excess mortality due to the famine. Nice logic, there, Borisov!

So, this is pretty silly and shallow stuff, but it is stimulating, and an excuse to talk about something since May, when Time reported the half-decade revision of the American population, as showing an increase of 10 million people from 1940 to 1945. I am not seeing that in the Census revisions, but the reported population on 1 July 1946 was 141,388,566, so almost a ten million increase. This is a slightly lower rate of population increase than the Twenties, but a lot more babies.

We knew that, of course, we're just stumbling over causes. Which is why I'm intrigued by the British quarterly figures, also reported in April, showing 221,891 live births in the last quarter

of 1946, or 20,5 per thousand of population. This is the highest for a December quarter

since 1941, with a mortality rate of 43 per 1000, 2 per 1000 below the previous

low. The net reproduction rate for the year was 1102, the first time reaching replacement level since 1922. What I'm taking from this is the drop in the mortality rate that accompanies the population increase. It is small, but presumably points to a decline in miscarriages and increase in conception rates that might make it more than a rounding error. Given that this points to a certain increase in the rude health of the British population that certainly isn't due to a reduction in overcrowding, better shelter or more sanitary conditions, I'm going to go with food as an explanation. Feeding people does make more babies. More babies mean more space. Does more babies mean fewer motorcycles?

Maybe all those economists who look back at the numbers and think that the ration cuts should have been a bit more strenuous, have a point? (And by "point," I mean, "Don't let's be monsters, lads.")

*London: Routledge, 1985; Reprinted Milton Park, etc.: Routledge, 2006.

**Feinstein, C. H. (1978) “Capital formation in Great Britain,” pp. 28-96 in P. Mathias and M. M. Postan (eds.) The Cambridge Economic History of Europe, Vol. 7 (pt. I). London: Cambridge Univ. Press.

***Cairncross and Eichengreen, Sterling in Decline: The Devaluations of 1931, 1949 and 1967, 2nd Ed. (Houndmills, etc.: Palgrave Macmillan, 2003)

****(London: Macmillan, 1990; reprinted New York: St. Martins, 1989.

*****Martin Chick, Industrial Policy in Britain, 1945—51: Economic Planning, Nationalisation and the Labour Governments (Cambridge: CUP, 1998) (21—3)

Only “6—9”% of prewar British housing stock had been lost in the war, compared with 20% in Germany, Poland and Greece, and with the large existing stock, the new house-building only added 1.5%. It's strange that the loss in housing stock should be the same in Poland and Greece as in heavily-bombed Germany

ReplyDelete"Poland" post-1945 hands over a big tract of sparsely populated steppe to Russia and receives in exchange much of West Prussia, all of East Prussia, and the target-y Silesian industrial basin. Also, Warsaw was deliberately razed and that would be a big fraction all by itself.

Greece is weird. There wasn't large-scale land warfare after 1941 and there weren't big air targets. Is this the micro-violence of civil war - torching the neighbours' house for being on the wrong side - rather than the macro-violence of air and artillery bombardment?

of gross domestic fixed capital investment in 1946, £1055 would be net investment, £540 million depreciation and maintenance. With a national income of £8120, this produced a ratio of 19.6% gross and 13% net. Gross investment is 5% higher than in 1938; net investment 40% lower

I see this as evidence of a huge inventory of deferred maintenance and hacky wartime fixes that needs catching up on or doing properly. Technical debt is a bitch! That said, losing to the Nazis is no fun either.

This is a really good and interesting post, by the way. I'd just like to add that Hunter S. Thompson rode a BSA Lightning 650, in an interesting example of British industry helping to create US subculture.

I had the sense that there was a west-east gradient of house-blowing-up that would favour the Poles, completely forgetting about the razing of Warsaw, which covers off the difference.

ReplyDeleteThe Greek case, on the other hand, seems like it demonstrates the extreme case of neglect. What does it look like if no-one repairs a roof for four years?

Subcultures, yes, yes. Do subcultures enjoy searching the side of the road for five miles looking for a thrown gear shift lever? (My Japanese bike subculture, in contrast, enjoyed choosing between opening up and rebuilding the transmission, or getting a new motorcycle; because the splines on the gearshift shaft had rubbed smooth. The official excuse is "No-one rides these things for more than 10,000 miles." The mechanics, of course, had never been asked to open up the transmission. Theoretically, they would say, it can be done; but I don't think anyone's ever actually bothered.)

I was not totally delighted hiking over miles of spinifex bush after the gear lever on the Yamaha 350 parted company and left it stuck in third and therefore impossible to restart, no.

Delete