So much for more talk about the Comet this week! (After a planned week off from work collapsed due to labour churn, before which it was going to be April, 1952, I, possibly with Flight and Fortune.)

Economists talk funny and never agree about anything, so you can probably just ignore them and watch Demi Moore do a full-bikini strip tease to the Eurythmics, "Money Can't Buy It," instead. If only the real world worked like that. It's kind of like how no-one explores what impact the tens of thousands of British military in the Canal Zone might have had on the citizens of Cairo in discussing the events of 1952. Apparently all that rioting and guerilla warfare was motivated by "nationalism" and "fanaticism," and the fact that the Sweet Water/Ismaili Canal, in spite of being the main source of drinking water for Canal Zone cities, was deemed to polluted to drink, isn't worth having a serious conversation about.

Catherine Schenck's 2009 paper, so helpfully posted online, reproduces the following:

USD might be the most reasonable international reserve currency, but the US export surplus means that any USD holdings are just going to be sold back to fund the rest of the world's current account deficit. One of the implications of being a reserve currency is an adverse trade balance, which permits the buildup of those very foreign exchange reserves. "The accumulation of international

reserves required persistent deficits to be run by issuing countries that ultimately

undermined confidence in the value of those reserves." (7) Many countries had large sterling holdings, but Britain's holdings of gold and USD were under siege. A sudden run on the pound would obligate the British to buy sterling with gold and USD, which British banks simply did not hold. On the other hand, Britain's insatiable demand for gold was good news for small town British Columbia and fanatical racists in South Africa.

Sterling was held in sterling area countries and colonies; in non-sterling area countries and colonies; by private parties, and by state institutions. In 1946, 58% of it was held on the Indian subcontinent, and reflected a very rapid change of India and Pakistan from debtor to creditor status due to large Indian loans to Britain to fund WWII. Schenck does not discuss Iran and Egypt, which were in a similar position, but skips forward to 1952. By this time, the subcontinent had moved as quickly as feasible to cash out these holdings, and by 1952 Indian holdings had fallen to 28% of sterling foreign exchange holdings. Egypt and Iran had transitioned into new relationships with the Bank of England which were not, as yet, fully resolved.

By 1968, those matters were behind Britain and its former sterling area partners, and Hong Kong, followed by Australia and Kuwait, were the largest sterling holders. Kuwait, and later Nigeria and Saudi Arabia, were in receipt of large royalty payments for oil exports. By 1975, these three countries held two-thirds of the overseas sterling balance, which had thus become an epiphenomena of the oil boom.

(Schenck, 16).

Ultimately, this system required international support. The Bank of England was given short-term lines of credit that allowed it to fight off speculative runs on the pound, and, who knows, maybe even make a profit off the speculators when the run collapsed. (That's where my cynical mind goes, anyway.) Could these runs be staved off forever? Who knows! As the Bank of England explained, the main cause of volatility was private holders, not public, and

". . . [F]undamentally, the UK’s creditors in the sterling area would not accept shifting their existing liquid sterling exchange reserves into less remunerative and less liquid long-term assets,and the UK did not want to replace a debt that might never need to be redeemed for a certain liability."

At this point, a crisis caused by a "loss of confidence in Labour" led to a run that could not be staunched, another devaluation of sterling, and a scheme to rescue sterling that either worked or not, it's hard to tell, because the final collapse of the Bretton Woods system was on us, and the four year run to Richard Nixon's euthanasia of the "gold standard" seems like a bit much to cover in a blog post, even if Dr. Schenck wants to take us through the rest of the story from the point of view of sterling.

Schenck is addressing the argument that the decline of sterling as an international reserve currency can be a model for the managed decline of the USD as a reserve currency in its turn. She argues, on the contrary, that the prolonged period in which there were two reserve currencies was a consequence of the special circumstances of the postwar world, and I see an argument peeking through that sterling's reserve status harmed the British economy, and perhaps gives us an explanation for the divergence between British and German industry in the postwar world. I wouldn't want to overstress this, but certainly Britain came under extraordinary pressures from international private holders to hold down inflation and maintain a higher bank rate than Hugh Dalton, in particular, thought advisable.

Turning from the long-delayed end of sterling as world currency to the specifics of the crisis of 1952 that so mysteriously went away on its own, let's preview some material from next week:

At this point these balances are unconvertible. British banks cannot buy the with gold or dollars. It is not clear how much of these holdings are longing to be converted, and an estimate gives us some interesting perspectives on where this money is held. For example, £409 million is in "unofficial European" hands, and will drain out into dollars given the chance. £57 million is the estimated holdings of Brazil and Uruguay, also blocked. Japan holds £100 million, unblocked, while Egypt still holds £200 million, unblocked, down £10 million just this week as Britain releases Egypt's "ration" early in consideration of persuading the Cairo police to turn out for riots.

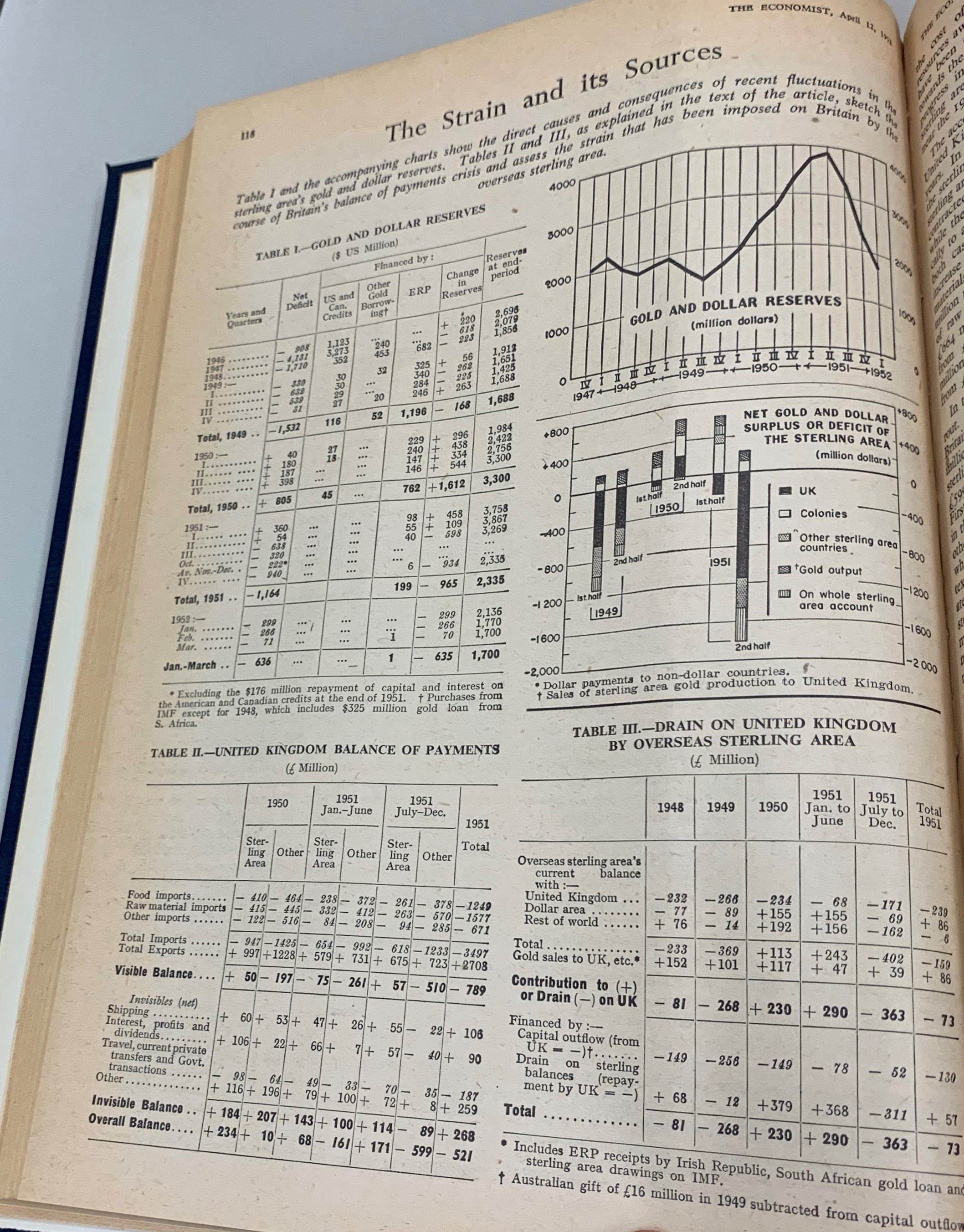

Here is a more comprehensive look from the same 12 April issue:

Some other material, which I am going to save for next week, I will preview here: the mysterious failure of the coal shortage of the winter of 1952 to eventuate. The Economist will take a very brief look at the numbers and conclude that they are down to "stagnation" in production during the winter of 1952, but in fact Britain has passed its peak coal consumption, and the explanation is the rise of oil. Britain will be a net oil importer until 1976, after which it will resume its post-Industrial Revolution status as an energy exporter.

1952--1976 is an interesting period in which Britain tried, and failed, to be what the moralists demanded that it be: workshop to the world. There are clearly systemic reasons why Germany and Japan, and not Britain, achieved that status. Those blocked sterling balances seem to have played a very large role.

"In 1946, 58% of it was held on the Indian subcontinent, and reflected a very rapid change of India and Pakistan from debtor to creditor status due to large Indian loans to Britain to fund WWII. Schenck does not discuss Iran and Egypt" // I've never really seen any discussion of the structure of these balances - how much was explicit intergovernmental lending and how much was defence spending that happened in this or that country and was financed by its reserve bank, with a corresponding sterling receivable (i.e. essentially issuing sterling or currency convertible to sterling to fund it)

ReplyDeleteYou can definitely see why HMT would be chary about doing the opposite of monetizing wartime debts - in the latter case the debt had been money-financed at an implicit zero interest rate, so the often proposed idea of "funding" the balances by swapping them for gilts would mean a large additional repayment bill, and one that would potentially add to the demand to swap sterling for dollars.

At the whole system level the balances represent part of the UK war economy's inflationary gap. If the Reserve Bank of India just let the extra cash circulate, obviously this means inflation concentrated in India; if the BoE issues enough sterling to pay it out, this means inflation in the UK and a lower pound (the international equivalent). In some sense, all actors in the system are trying to push off the inflationary consequences of the war on each other.

Instead, America gets all the inflation --and thanks to Bretton Woods, comes out ahead!

DeleteIt eez, as they say, no accident that the last of the true sterling crises is 1976 - kicked off by Nigeria wanting to dollarize a bunch of oil money and *the year the first North Sea oil landed*.

ReplyDelete